In the words of Komori’s chairman, Komori’s basic idea is that the sales department sells the first machine, the factory sells the second machine, and its service sells the third machine, Satoshi Mochida, president and CEO, Komori Corporation Japan, explains. You can read more in the Sunday Column

PrintWeek (PW), 2022 is behind you. What’s your 2022 reportcard?

Satoshi Mochida (SM): 2022 was the Year of the New Normal, and the recovery in international business confidence. Due to China’s zero-Covid policy, however, the business suffered in the second half. Manufacturing costs have been impacted by the global semiconductor shortage and rising steel and energy prices. Although the weaker Japanese yen was a tailwind to our company’s overseas exports, it did not work in our favor.

PW: The years 2022 to 2020 were volatile. Which has been more challenging for you: expansion or the status quo. Lessons learnt?

SM: Covid-19 also caused an economic slowdown which affected us in the exact same way. Covid-19 made digitalisation possible and it helped to clarify what was and wasn’t necessary. The same thing is happening with the printing industry. We believe paper media holds great potential.

PW: What is customer development to you? PW: What’s the most interesting customer development case you could share with us?

SMToday’s world is complex. It is hard to make products that are global leaders with just one product. Customer development, we believe, is about creating products that satisfy customer needs in every market and creating new business models for customers. Komori should focus on problem-solving in these situations, especially in Asia.

PW: The K in Dusseldorf and Labelexpo in India concluded on a high note. In 2023 and 2024 there are three important exhibitions: Labelexpo Europe in Brussels, Interpack/Drupa Dusseldorf, and Labelexpo Europe in Brussels. What should we expect of you at these shows

SM: Drupa is the place where we plan to exhibit right now. Others are yet to be decided, but Komori plans to promote automation that removes the need for manual labor and increases labour productivity through connected automation. At IGAS, held in Japan in November 2022, production visualisation and process linking using KP-Connect, Komori’s IoT cloud, autopilot for fully automated operation of printing presses, and logistics using a palletising robot and an AGV were demonstrated and well received.

Additionally, I want to promote our efforts in addressing environmental issues. I’d like to highlight what Komori can accomplish to address rising energy prices, which has become a major topic in recent times, and eventually to create a carbon neutral society.

PW: Can paper, paperboard and label converters still manage business and manufacturing operations using industrial-age processes despite being part of the knowledge age What is the industry’s knowledge gap? How do we bridge it? How can Gen Z be convinced about the efficacy of ink on papers?

SM: As I said, the paper media industry is experiencing major changes after the emergence of Covid-19. Paper containers are now booming as people try to eliminate plastic. But paper media is adapting and growing with the times. Each time we get closer to products that are directly appealing to consumers, I believe we are. I can’t imagine exactly what kind of paper media will emerge in the future, but I believe that printing technology and paper media will become even more closely related to the B2C business.

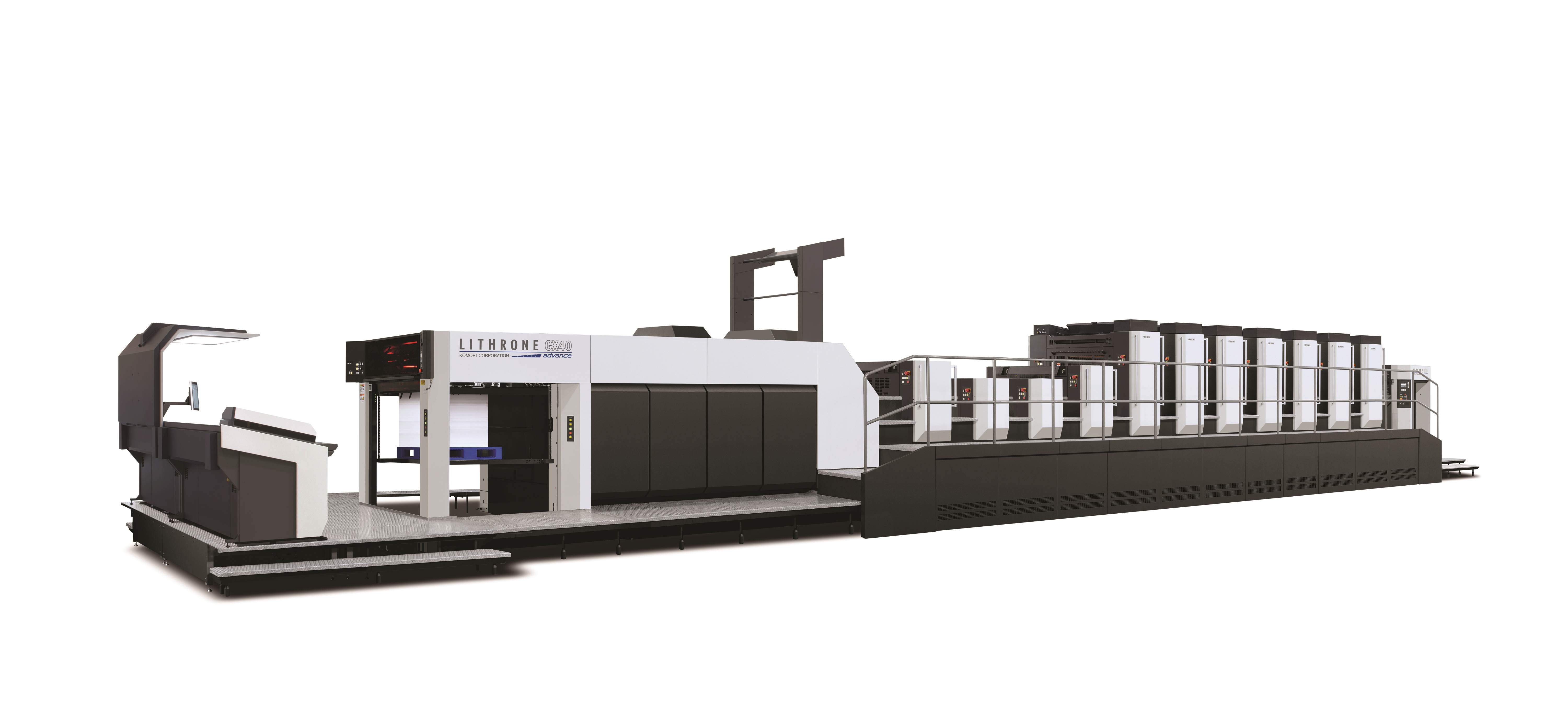

Komori Lithrone X 40 press

PW: What industry standards are there today for overall equipment efficiency (OEE). What kind of return on investment can an OEE program provide?

SM: KPConnect can help us understand the operating rates of printing companies. However the OEE operating ratio is usually low and varies depending on the printed material. OEE can be useful if used for one company. But it is important to look at it closely to compare it with other companies, and to set general targets values. We want to visualize the production process in a more general way, calculate the cost for each sheet and allow judgments based upon profit per hour.

PW. India is a price sensitive market. Yet, the trends are always changing. How can a mass producer of goods stay relevant? What innovations in products can one offer consumers to disrupt the market or create new trends?

SM: Looking at India’s demographic trends, I believe that India will become a centre of global consumption in the future. Markets with growing populations tend toward standardised trends, but in today’s digital society, information from throughout the world reaches individuals. It is possible to quickly integrate global trends and make them available in a format that suits Indian people.

PW: Would you consider remanufacturing as an alternative? One Indian manufacturer of post-press equipment has successfully repurposed bindings. What’s your view – advantages versus disadvantages?

SM: The basic components of printing presses can be manufactured with durability that will last for many decades. Remanufacturing is important for both the environment and acquisition costs. There is a significant difference in productivity between modern machines versus machines 10 years ago. The quality is improving rapidly, however.

Remanufactured machines can be a headache because of the possibility of quality and breakdowns. However, new machines will increase employee motivation. We believe that new presses are more expensive than remanufactured machines. We hope that the customer will buy a machine with a Komori manufacturer guarantee when they purchase a remanufactured one.

PW: The F&B packaging market in India is expected to grow from USD 33.2-billion in 2020 at a CAGR (compound annual growth rate) of 9.3% until 2026. Based on our basic calculations, India’s consumption of packaged food increased by 200% over the past ten years, rising from 4.3-kg to 8-kg per person annually. A further 23% of PET packaging uses are made by the beverage industry. India has high consumption patterns. What is the best way to manage a circular economy in such conditions?

SM: All individuals and companies must raise environmental awareness and take responsibility for their environment. But I believe the printing industry is very close to this goal. The printing industry can lead the way in creating a recycling society by switching from paper to natural materials like paper and making packaging less complicated and more useful.

PW: How can you deal with greenwashing as part your sustainability/circular economy communications?

SM: Our business is primarily a B2B one. The environmental appeal of our products does not directly correlate with the buying behaviour of consumers (purchasers). We intend to increase the availability of environmental information in future and are working hard to present the facts using actual data.

The Tsukuba factory consists of a factory, a research center, KGC – a learning centre – and facilities that provide benefits for the employees

PW: The structural design of packaging, which embraces a pack’s shape, texture, materials, and product delivery capability, has mostly stayed the same. How can the industry approach structural packaging innovation in the future? Through new product formats and new offerings like craft beer and paneer; eco-friendly, extended shelf life – Modified Atmospheric Packaging

SM: Japan is an excellent example. Many people still throw away paper packaging, despite the high recycling rates for cardboard. Surface processes like PP film laminating which is used to make paper containers more durable and waterproof and to display the contents with plastic materials will be revisited.

One way to counter this is to design a packaging system that encourages recycling and promotes the use of paper as packaging. It is also expected that the amount of paper made out of waste materials (bagasse, sugarcane materials and apple tree branches chopped down for growth) will increase in the future. This paper should be used for packaging products starting at the planning stage.

Japan’s paper container packaging is also considered to be excessively high quality. For example, there are many individual packages in Japan. To ensure additional orders, large quantities of stock are kept in anticipation. A lot of waste can be caused by design changes and defects.

We think digital printing systems will offer a new way to market on-demand printed products. We believe that by producing only the amount required, we can manage smaller lots and transform to a system that doesn’t require inventory.

PW. The Government of India has a vision of an economy worth USD 5 trillion. What are your views on India’s opportunities for the printing and packaging industry and your company?

SM: We believe India will be a major market in future. This is why we set up a subsidiary in India in 2018. But the Indian market has unique challenges. They are more challenging than those faced in other developed countries. We believe it is important to have a thorough understanding of India’s printing industry, understand Indian business, grasp the issues, and create products for India. One example is the Enthrone line of small, sheetfed presses that are currently being shipped to India.

PW: When the USD 3.1-trillion current economy grows to a US 5-trillion economy, India’s printing industry, and especially the packaging sector, will see significant growth. One number states that India’s packaging consumption has grown 200% in the last decade. It has gone from 4.3-kg per individual per annum (pppa), to 8.6 kg pppa in FY20. How ready are you to help India’s packaging and print factories?

SM: Manufacturers are introducing products to the Indian market. It will be a problem for our customers if we can’t provide after-sales services that are appropriate for the market. India has a high number of service personnel, which is second only to China and Japan. This number keeps growing every year. In the words of Komori’s chairman, “Komori’s basic idea is that the sales department sells the first machine, the factory sells the second machine, and its service sells the third machine.”

PW: India’s business leaders are too focused on their investments and machines. Soft power is often overlooked. This includes culture, team-building and delegation. It also covers housekeeping. What is your opinion?

SM think it’s proof that consumption power is vigorous in the economy. If firms’ consumption power falls, their one-way power is diminished. Soft power is a great tool in this situation. By defining the company’s mission and vision and clarifying the employee code of conduct, it becomes possible to direct the vector of these dispersed employees in one direction. It is crucial to do these efforts when consumption power is high. This will be a great asset for the future.

PW: Takeaway from your autobiography (if one is written)

SM: Persistence pays off.

Satoshi Mochida: at a Glance

Fav most app?

Teams.

You should also have your wallet and phone. What are the essential items that you must always have?

A handkerchief.

Window or aisle seat?

Window seat.

What about a snack or meal?

Meal.

Cocktail or diet drink?

Cocktail.

Luxury or SUV?

SUV.

What’s the current author you are bingeing on?

DT Suzuki (An Introduction into Zen Buddhism)

What is the most impressive celeb you have met?

Chiune Sughara (for his humanity, strong will and kindness).

What is the first thing you notice at a business meeting?

Prejudice and superficial analysis can lead to misunderstandings.

Do you have a question that you must ask before you start hiring people?

Language proficiency.

What’s the one thing you wish you knew at age 21?

It is possible to identify problems by first describing an ideal.

What’s the best piece of advice you’ve received?

Hold firm to one’s principles.